What is Nifty Bees ?

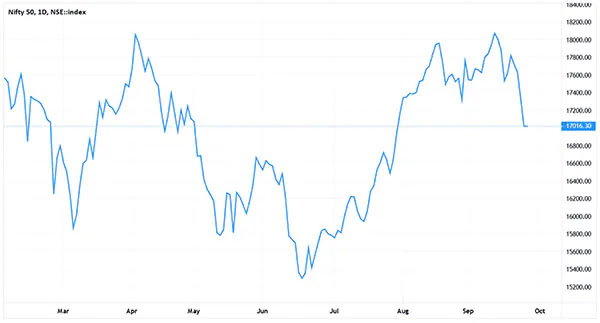

Hello friends. let's understand passive. Nifty Bees is the very first exchange traded fund (ETF) launched in India, and it tracks the Nifty 50 Index. It was introduced in India by Benchmark Asset Management in December 2001. After some change of hands, it now belongs to Nippon India Mutual Fund. The “Nifty” in its name represents the index that it tracks and Bees is short for ‘benchmark exchange traded scheme’. Let’s take a step back and take a quick look at ETFs and the Nifty 50 index. Nifty 50 Index The Nifty 50 index is one of the two most widely used indices for the Indian markets, with the other being the Sensex. The Nifty (a combination of NSE and Fifty) 50 indices , is a diversified benchmark index that tracks the performance of the top large-cap companies listed on the NSE. It is owned and managed by NSE Indices Limited and as the name indicates, comprises 50 stocks covering 13 sectors. It is computed using the free float market capitalization method and its value is calcu...