Hello friends.

lest s understand most demanding pattern in stock market

Breakout Pattern

Breakout in Technical Analysis refers to when the price of an asset moves above a resistance area or moves below a support area. Breakout Patterns are commonly associated with ranges or other chart patterns. This includes triangles, wedges, head and shoulders, flags etc. Breakout patterns may initiate long positions or exit short positions if the price breaks above the resistance. Breakout patterns may initiate short positions or exit long positions if the price breaks below support. Learning about Breakout Patterns and identifying potential breakout stocks gives traders one more tool that they can use to generate profits.

Price action within the share market is affected by supply and demand when a breakout signal occurs this usually means here the buyer has succeeded in pushing the stock’s price above the resistance level. If there is a downside or negative breakout pattern, sellers have pushed the price below support.

What is A Breakout?

The kind of the trader that uses the strategy of breakout trading is called a breakout trader. This trading strategy searches for areas or levels that a stock has been unable to move above and beyond. A trader who practices this method waits for these stocks to move higher. When the price goes above the point at which the stock has been stuck for a period, this circumstance is called “breakout”.

Entry Points In Break Out Strategy

In entry points when it comes to establishing positions on a breakout it behaves fairly black and white. Once the price are set back to resistance level an investor will establish a bullish position. And similarly, when the prices are set to close below a support level an investor will take a bearish position. To understand the difference between breakout and fake out wait for confirmation. Fake out means when the prices open beyond a support or resistance level, by the end of the day they wind up to the prior trading range.

Planning Exits

In a successful trading approach planning the Exits is very important. There are 3 ways to plan the exits.

1. Where to Exit with a Profit

While trading it is important to know when to exit. The trading price patterns must be observed. Also, another idea is to calculate recent price swings and average them out to get a relative price target. If the stock has made an average price swing of four points over the past few price swings this can set as price target. When this target is reached investor can exit the portion of position and rest can run. Or else the trader can set a stop loss order to lock in profits.

2. Where to Exit with a Loss

It is important to know when the trade can make loss. Breakout strategy helps to get a clarity regarding this loss. After a breakout, the old resistance levels usually act as new support and old support levels act as new resistance. This helps us to when to place stop loss order. After the position has been taken, use the old support or resistance level to close the losing trade.

3. Where to Set a Stop Order

When you are considering where to exit a position with a loss, use the prior support or resistance level beyond which the prices have broken. Placing a stop loss within this parameter is in a way a safe way to protect a position without giving trade too much downside risk. Setting the stop below this level allows prices to retest and catch the trade quickly if it fails.

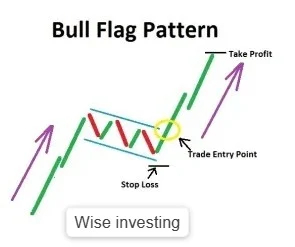

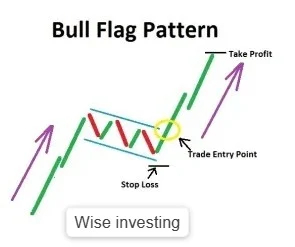

What Is A Flag Pattern?

Flags are the price pattern that moves to the prevailing price trend observed in a longer time frame on a price chart. It is named because of the way it reminds the viewer of a flag on a flagpole. The flag pattern is used to identify the previous trend from a point at which the price has drifted against the same trend. Flag patterns are either upward trending or downward trending. Upward Trending are Bullish Trends and Downward Trending are Bearish Trends. Let us understand each.

1. Bullish Flag

In bullish flag pattern the price action rises and then declines. The breakout may not always have high volume surge, but analysts and traders prefer to see one because it shows how the investors and traders have entered the stock with new enthusiasm.

2. Bearish Flag

In the bearish flag pattern, the volume does not always decline in the area of consolidation. The reason for this is that the downward trending price moves are usually driven by investor fear and anxiety over falling prices. When the price pauses its downward trend, the volume may not decline but rather hold at a level.

1. Identify the Breakout Stock

While trading with Breakout Stocks it is important to identify stocks which are having strong support or resistance level. The stronger the support and resistance level the stronger will be the move from the breakout.

2. Wait for the Breakout

The trader should wait for the breakout and do not do any trade prior to the breakout. The trader should wait patiently for the stock prices to move.

3. Set a Reasonable Objective for Breakout Stocks

When you are going to trade with the breakout stock then the trader will have to set an expectation of where it will go. This helps in knowing the exit points.

4. Allow the Stocks to Retest

This is considered as the most important step with breakout stocks. When the stock price breaks a resistance level, old resistance becomes new support. When a stock breaks the support level, the old support becomes new resistance.

5. Know When Your Trade/Pattern Has failed

As knowing the profit level is important, knowing your failures is also important. If the stock retests the previous support or resistance level and breaks back through it, this is where the pattern is breakout or failed. At this level, the trader has to accept the loss.

6. Exit Trades Towards Market close

In breakout strategy if the stock has remained outside a predetermined support or resistance level towards the market close, it is an indication for the trader to close the position and move on to the next.

7. Exit at Your Target

The trader should not exit the trade unless it reaches its target price, or it reaches its targeted objective.

Wise investing

Grow with education.

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas