Support and resistance trading strategy

Support and resistance trading strategy

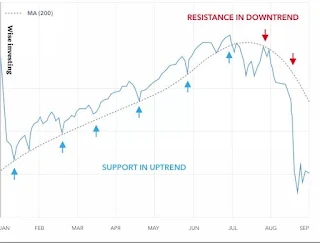

Using support and resistance levels as a trading strategy is one of the very basic methods of trading. It can be used to manage risk and place stops, determine the market conditions, and find appropriate entry and exit positions. The most common trading strategy using support and resistance levels is buying (going long) when the price is closing in on the support level and selling (going short) when the price is moving closer to the resistance level. However, traders should wait for some confirmation that the market is still following the trend.

Placing stops and limits below support and above resistance is also recommended. It helps traders to close a position quickly if the price breaks through levels of support or resistance. Before you place the trade, consider your profit target and what you consider to be an acceptable level of loss, then decide on your exit points near the support and resistance levels.

Another strategy used in support and resistance trading is the breakout strategy, whereby traders wait for the stock price to move outside either level. A breakout is not just a slight movement beyond the support or resistance levels. It is defined by particularly sudden and rapid movement with increased momentum, which creates opportunities for profit.

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas