What is a Short Squeeze in trading ?

A short squeeze in trading

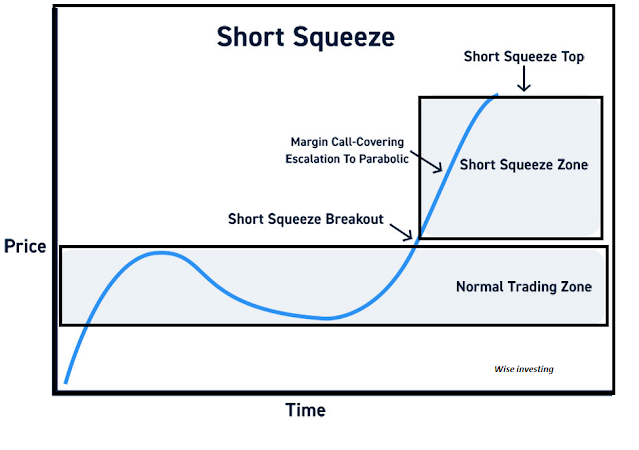

A short squeeze occurs when the price of a stock rises sharply, forcing short sellers to buy shares to exit their positions. In buying shares to cover their short positions, short sellers end up pushing the stock price even higher. Bullish traders see this buying activity and jump in as well, adding further upward pressure to the share price. In this way, a relatively small bullish movement can trigger in a cascade of buying activity.

Short squeezes typically happen only when the short interest in a stock is very high. It takes a lot of short sellers buying shares to push the price of a stock strongly upward. Short squeezes are usually short-lived and end when short sellers have fully exited their positions or stop buying shares to cut their losses.

Short Squeezes vs. Breakouts

Short squeezes and breakouts both involve strong bullish movements in the price of a stock. However, the underlying dynamics are very different.

In a short squeeze, a stock’s upward movement is driven by short sellers buying shares to exit their positions and bullish traders piling in. The trading activity is usually highly volatile and somewhat frantic since the fuel behind the price movement – open short positions – will run out at some point. Short squeezes often end in a sharp peak, after which prices usually drop to near or slightly above the level at which the short squeeze began.

In a breakout, a stock’s price moves above an area of resistance and then moves to a sustained higher price level. Breakouts are usually supported by strong bullish trading volume and do not primarily involve short sellers buying shares. Breakouts may see a price peak form, but the stock’s price typically stays above the prior resistance line following a successful breakout.

lets understand with image

Note that a short squeeze can be the catalyst for a breakout or vice versa. During a short squeeze, a stock may break above a resistance level and sustain a price above that level. Alternatively, a breakout could trigger buying activity that alarms short sellers and causes them to exit their positions, initiating a short squeeze.

Why Traders Need to Be Aware of Short Squeezes

Traders need to be aware of short squeezes because their dynamics can be very different from traditional breakouts.

Short squeezes can be extremely volatile, with buying pressure pushing a stock’s price far above its last support level. Traders who have bullish positions around a short squeeze for too long could find themselves riding a downward crash back to areas of support. Long traders need to be aware of what is moving a stock’s price and consider how long that movement may last.

Short sellers also need to be cautious around short squeezes. What might look like a better price to short a stock could end up being the beginning of a sharp upward movement. If short sellers jump in, they could end up being forced to quickly exit their positions for a loss.

How to Recognise a Short Squeeze

There are several ways that traders can recognise a short squeeze in action.

Check the Float

Stocks with low floats are also more susceptible to short squeezes. Low float stocks have fewer shares available for public trading, so short sellers will generally have a harder time covering their positions. Low float stocks are also typically more volatile than stocks with high float, which can help trigger a short squeeze.

Look for Volatility

Unusually high volatility could be a sign that a short squeeze is about to happen. Higher volatility may be due to short sellers starting to exit their positions in a hurry. High volatility could also induce a short squeeze if short sellers see that a stock has a very high days to cover ratio.

Look for Higher Relative Volume

Unusually high trading volume can be a sign that short sellers are buying shares to cover their short positions. As bullish traders try to trade around the squeeze, trading volume will rise even higher. However, bear in mind that high trading volume is also associated with bullish breakouts.

Check the Trend

Short squeezes can happen during either up trends or downtrends. However, a squeeze in a downtrend is less likely to occur because short sellers are less likely to experience margin calls (if they are holding unrealised profits in their short positions). Short sellers who hold unrealised profits may also be less incentived to exit their positions if a stock is in the midst of a prolonged downtrend.

That said, if a stock starts squeezing after a longer-term downtrend, a short squeeze may ensue. Short sellers who were previously comfortable with their positions may be inclined to cover as the stock turns against them.

Conclusion

Short squeezes can present unique opportunities for trading, but they can be highly volatile and require caution. The first step to trading short squeezes is to recognition when one is happening. Traders should consider a stock’s short interest, float, volume, and any catalysts to determine whether a short squeeze is developing.

I hope you like the Content stay ahead of others

Wise investing

knowledge is growth

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas