What is the tax to be paid for F&O trades?

Hello friends lets understand most complicated subject for F&O traders

F&O income may start getting the same tax treatment as

lotteries and cryptocurrencies. Currently, income from F&O transactions is

treated as a business income and taxed according to in come slab slabs of

5%,20%, 30%

What is the tax to be paid for F&O trades?

Income from trading in F&O (both intraday or overnight) on all the recognized exchanges (such as NSE, BSE, MCX etc) is considered as non-speculative business income f&O TRADE. is reported under the head ‘Business’ in Income Tax Return (“ITR”) and information is given as per the frequency or volumes of trades done.

What

is the turnover in derivatives?

Turnover

is calculated as the difference of total of positive and negative values for

Futures segment. It makes no difference, whether the difference is positive or

negative. These values are aggregated and the turnover is calculated. With

respect to Options, Premium is to be included in turnover.

Let’s

take a look below examples

- If client bought & sold

RIL one lot Future contract and booked a profit of Rs. 50,000.

- If client bought & sold

TCS one lot Future contract & booked a loss is Rs. 25,000

- If client bought INFY 1700 CE

one lot at a premium of at Rs. 12,000.

- If client sold ITC 230 PE one

lot at a premium of Rs. 22,400.

The

turnover is calculated as Rs. 50,000 (Profit in RIL ) + 25,000 (Loss in TCS) +

buy premium of INFY CE Rs. 12,000 + sold ITC PE premium of Rs. 22,400 then

total turnover is Rs. 1,09,400.

Treatment

of losses in derivatives

Any

unadjusted loss in derivatives can be carried forward for eight years. However,

in the future, they can only be adjusted from non-speculative income. If

there is a loss in F&O, then one should file it before due date to carry

forward the loss and set off from income in the future. The single most

important reason to file F&O trading is to be able to benefit from losses

you have incurred. If your business resulted in a loss, report it in your tax

return. It can be adjusted from income from remaining heads such as rental

income or interest income (it cannot be adjusted from salary income).

When

is derivative tax audit required?

TAX Audit

in the case for Futures & Options (F&O) is applicable in the below two scenarios:

-

1.The

turnover is more than Rs. 10 crores (audit applicability increased from Rs.5

crores to Rs.10 crores in Budget 2021). The threshold of Rs.10 crores is

applicable for F&O as 95% of the transactions are through digital mode.

Hence, the standard audit threshold of Rs.1 crore is not applicable in case of

F&O.

2.The

audit is required only if a taxpayer has declared income at a presumptive rate

(Section 44AD) in any of the previous five years but wants to declare losses or

income at less than the presumptive rate in the current year, provided his

total income in the current year exceeds the basic exemption limit.

What are types of ITR forms and where

do I fill Derivatives Income Tax?

ITR-

3 for individuals and HUFs having income from profits and gains of business or

profession.

ITR-4

for Individuals, HUFs and Firms (other than LLP) who are eligible to opt

‘Presumptive taxation scheme’.

How

can I file tax if I am a small trader & do not maintain Books of account?

This

is applicable to Business/Profession whose gross receipts /revenue is less than

or equal to ₹25 Lakhs (10 Lakhs for Profession) and profit is less than or

equal to ₹2.5 Lakhs (1.5 Lakhs for Profession)

What documents are required for tax

filing?

FORM 16 Form

26AS Tax Credit Statement, trading account statement, Turnover report, profit

& loss, transaction statement, bank statement if interest received is above

Rs. 10,000/-, gross receipts & Income and Expense statements.

What is advance tax and

when do I need to pay it?

The

assessment of income of a year can be made only after the year has passed,

advance tax is pre-payment of your tax liability in the year it is earned. If

the tax liability is more than Rs 10,000 in a financial year then advance tax

needs to be paid by assessee. The dates are June 15, September 15,

December 15 and March 15 are the dates to pay advance tax.

How are

Open position/ closing position on 31st March

considered for calculation of P&L?

Open

interest refers to a situation, wherein on the date of the financial year end,

there are outstanding derivatives contracts with the customer. Since

derivatives contracts are marked-to-market (MTM), there can be unrealized MTM

gains or losses prevailing as on March 31.

Only

real income/loss attracts tax provisions and not the notional gains/losses.

However, in certain judicial decisions notional losses have also been allowed

as a deductible expense. This is still debatable and there is no fixed rule

yet.

Expenses treatment

against F&O Income?

Expenses

like brokerage, broker’s commission, subscriptions to journals related to

trading, telephone bills, internet costs, consultant charges if you took an

advice from a professional who charged you, or salary of a person you hired to

help with your business can all be claimed.

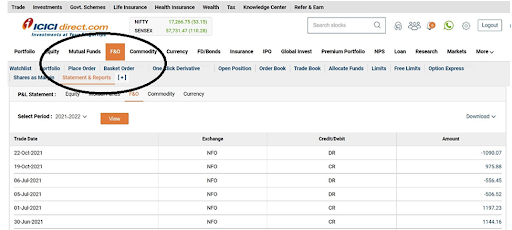

Where can client see profit and loss statement

YOU CAN YOU BACK OFFICE – OF YOUR BROKER YOU HAVE SELECTED

Can clients use P&L statement for

income tax return?

Yes,

clients can download statement for financial year & total is given in the

statement

Wise investing

Knowledge is power

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas