What are the different types of Straddle?

HELLO EVERY ONE LETS UNDERSTNAD NEW TOPIC

There are several variations of the core straddle strategy, which involves simultaneously buying a put and call on the same underlying asset. The different types of straddles are distinguished by their option strike prices, expiration dates, and construction methods.

The 10 main types of straddles are given below.

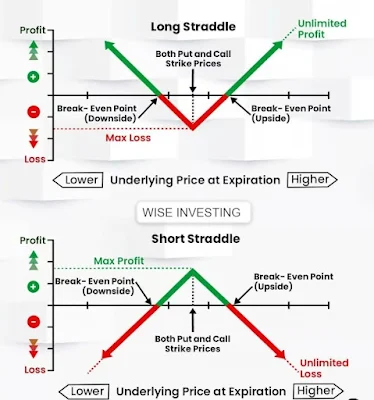

1. Long Straddle

The basic, traditional Straddle involves buying an at-the-money put and calls with the same strike price and expiration date. It is the most common Straddle, offering unlimited profit potential and capped loss at the cost of the premiums.

2. Short Straddle

This involves writing or selling both a put and call option on the same stock at the same strike and expiration. The trader collects the premiums upfront but has uncapped downside risk if the stock moves substantially in either direction.

3. Zero-Cost Collar Straddle

Also known as a synthetic straddle, this uses a protective put funded through selling a covered call. There is no net debit taken, creating a zero-cost trade. Gains are limited to the upside beyond the call strike.

4. Calendar Straddle

Rather than buying options expiring on the same date, this uses options expiring in different contract months. For example, buying a nearer-term put and longer-dated call, or vice versa. Provides more timing flexibility.

5. Diagonal Straddle

A diagonal straddle combines a long call and a short put or a long put and a short call. The options have different strikes and expiration months. Provides some premium collection.

6. Straddle Spread

Involves buying a straddle while also selling a call and put with farther out-of-the-money strikes. This helps offset the cost of the Straddle through the short strikes but caps upside potential.

7. Strangle

Buys out-of-the-money call and put options with the same expiration. It is cheaper than a straddle due to the OTM strikes but requires a larger price move to profit.

8. Long Strangle Spread

Buys an OTM strangle while shorting a call and puts at even farther OTM strikes. The short strikes serve to reduce the cost of implementing the strangle.

9. Iron Butterfly Straddle

Combines a long straddle with a short strangle, consisting of both an OTM call and an OTM put sold against the straddle strikes. Offsets long straddle costs.

10. Long Condor Straddle

It involves buying a straddle, then selling a call spread and put spread, yielding four total options. The short spreads reduce net costs but also limit the profit potential.

1.Long Straddle

A long straddle is when a trader buys a call and puts it with the same strike price and expiration

.

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas