All about MF industry & growth matrix

The mutual fund industry

in India started in 1963 with the formation of Unit Trust of India, at the

initiative of the Government of India and Reserve Bank of India. The history of

mutual funds in India can be broadly divided into four distinct

First Phase - 1964-1987

Unit Trust of India

(UTI) was established in 1963 by an Act of Parliament. It was set up by the

Reserve Bank of India and functioned under the Regulatory and administrative

control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI

and the Industrial Development Bank of India (IDBI) took over the regulatory

and administrative control in place of RBI. The first scheme launched by UTI

was Unit Scheme 1964. At the end of 1988 UTI had Rs. 6,700 crores of assets

under management.

Second Phase - 1987-1993 (Entry of Public Sector

Funds)

1987 marked the entry of

non-UTI, public sector mutual funds set up by public sector banks and Life

Insurance Corporation of India (LIC) and General Insurance Corporation of India

(GIC). SBI Mutual Fund was the first non-UTI Mutual Fund established in June

1987 followed by Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund

(Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of

Baroda Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while

GIC had set up its mutual fund in December 1990.

At the end of 1993, the

mutual fund industry had assets under management of Rs. 47,004 crores.

Third Phase - 1993-2003 (Entry of Private Sector

Funds)

With the entry of

private sector funds in 1993, a new era started in the Indian mutual fund

industry, giving the Indian investors a wider choice of fund families. Also,

1993 was the year in which the first Mutual Fund Regulations came into being,

under which all mutual funds, except UTI were to be registered and governed.

The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the

first private sector mutual fund registered in July 1993.

The 1993 SEBI (Mutual

Fund) Regulations were substituted by a more comprehensive and revised Mutual

Fund Regulations in 1996. The industry now functions under the SEBI (Mutual

Fund) Regulations 1996.

The number of mutual

fund houses went on increasing, with many foreign mutual funds setting up funds

in India and also the industry has witnessed several mergers and acquisitions.

As at the end of January 2003, there were 33 mutual funds with total assets of

Rs. 1,21,805 crores. The Unit Trust of India with Rs. 44,541 crores of assets

under management was way ahead of other mutual funds.

Fourth Phase - since February 2003

In February 2003,

following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated

into two separate entities. One is the Specified Undertaking of the Unit Trust

of India with assets under management of Rs. 29,835 crores as at the end of

January 2003, representing broadly, the assets of US 64 scheme, assured return

and certain other schemes. The Specified Undertaking of Unit Trust of India,

functioning under an administrator and under the rules framed by Government of

India and does not come under the purview of the Mutual Fund Regulations.

The second is the UTI

Mutual Fund, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and

functions under the Mutual Fund Regulations. With the bifurcation of the

erstwhile UTI which had in March 2000 more than Rs. 76,000 crores of assets

under management and with the setting up of a UTI Mutual Fund, conforming to

the SEBI Mutual Fund Regulations, and with recent mergers taking place among different

private sector funds, the mutual fund industry has entered its current phase of

consolidation and growth.

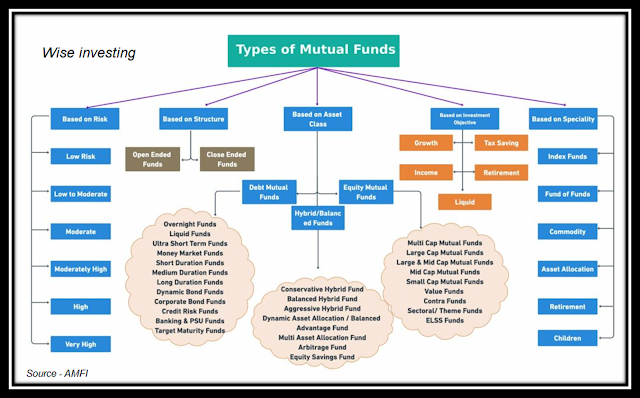

Types of funds in (India)

·

Multi Cap Funds

·

Large Cap Funds

·

Large & Mid Cap Funds

·

Mid Cap Funds

·

Small Cap Funds

·

Value Funds

·

Contra Funds

·

Sectoral/ Theme Funds

·

ELSS Funds

·

Overnight Funds

·

Liquid Funds

·

Ultra Short-Term Funds

·

Money Market Funds

·

Short Duration Term Funds

·

Medium Duration Term Funds

·

Long Duration Funds

·

Dynamic Bond Funds

·

Corporate Bond Funds

·

Credit Risk Funds

·

Banking & PSU Funds

·

Money Market Funds

·

Hybrid or Balance Advantage Mutual Funds

·

Conservative Hybrid Fund

·

Balanced Hybrid Fund

·

Aggressive Hybrid Fund

·

Dynamic Asset Allocation or Balanced Advantage Fund

·

Multi Asset Allocation Fund

·

Arbitrage Fund

·

Equity Savings Fund

·

Target Maturity Funds

·

Index Mutual Funds

·

Fund of Funds

·

Commodity Funds

·

Asset Allocation Funds

· Retirement Funds

Assets Under Management (AUM) of Indian Mutual Fund Industry as on October 31, 2023, stood at 46,71,688 crores. The AUM of the Indian MF Industry has grown from ₹8.34 trillion as on October 31, 2013, to ₹46.72 trillion as on October 31, 2023, more than 5-fold increase in a span of 10 years.

Top fund manager in single image

List of AMC companies in India in Singel IMAGE

Growth with knowledge share your thoughts.

wise investing.in

.png)

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas