How is Sensex Calculated?

Hellow friends lets understand.

how Sensex is calculated

Since my early days of involvement in the stock market, I was intrigued by the number called Sensex (A BSE Index). I always wanted to know how Sensex is calculated. What is fascinating about Sensex is that, when it is rising or falling, almost all stocks

Stock market

I started investing in

the Stock market in the year 2008. During that time, Sensex crashed more

than 50%, from 20000 to 9000 points. The cause of the crash was

the Subprime mortgage crisis in the US. When the index fell, even large

stocks Crashed heavily.

Sensex’s rise and fall

getting replicated by other stocks was a surprise for me. I wondered, what is

the correlation between Sensex and individual stocks. The answer I got while

researching about “how Sensex is calculated”.

Before the COVID

crash of 2020, Sensex was at 41,170 points (20-Feb-2020). Today (23-Aug-21)

value is around 55,508 points. We keep seeing these numbers on our Screens.

What are these numbers, how it is calculated? That is what we will decipher

here. But before that, an interesting historical fact about the BSE.

Sensex is the main

index of BSE (Bombay Stock Exchange). Not many people know that the Bombay

Stock Exchange is the 10th oldest stock exchange in the world. It is also the

oldest stock exchange in Southeast Asia. BSE got established by Premchand Roychand in

the year 1875.

Premchand Roychand

was a Surat-born, Bombay-based stockbroker and businessman. He was among the

founders of “The Native Share

& Stockbrokers Association.” This association is now called

BSE (Bombay Stock Exchange).

All stock markets

have their index. Like, for USA Stock Market is S&P 500 and NASDAQ. For the

London stock exchange, it is FTSE100, and for India’s NSE, it is Nifty.

Similarly, for the

second-biggest stock exchange of India (BSE), the main index is called Sensex.

It is an acronym for the Sensitive

Index (Sensex).

Sensex Listing

Criteria

There are a few Criteria based on which a stock becomes

eligible for getting listed in Sensex. Among all other criteria’s the most

important one is market capitalization. If a share is not among the first 100

stocks by market cap, it will not become eligible.

Below is Criteria source Bse

Qualification Criteria : The general guidelines for selection of constituent

Securities in S&P BSE SENSEX® are as follows.

A. Quantitative Criteria:

·

Market Capitalization: The Security should

figure in the Top 100 companies listed by full market capitalization. The

weight of each S&P BSE SENSEX® Security based on free float should be at least

0.5% of the Index. (Market Capitalization would be averaged for last six

months)

·

Trading Frequency: The Security should have

been traded on each and every trading day for the last one year. Exception can

be made for extreme reasons like Security suspension etc.

·

Average Daily Trades: The Security should

be among the Top 150 companies listed by average number of trades per day for

the last one year.

·

Average Daily Turnover: The Security should be

among the Top 150 companies listed by average value of shares traded per day

for the last one year.

·

Industry Representation: The only difference

between SCM and TCM is that SCM does not have the rights to clear the trades of

other members he can only clear his trades, whereas TCM can clear the trades of

any other member

·

Listed History: The Security should have a

listing history of at least one year on BSE.

Furthermore, it is also imperative to include a variety of

stocks in the index. The idea is that the constituent stocks together shall

function as a representative of all sectors/industries of the market. They must

reflect the sentiment or mood of the overall market.

In the BSE, about 4000-5000 numbers of active stocks are listed

and traded each day. The selected Sensex-30 companies represent all the

listed stocks.

How is Sensex

Calculated?

Following are the seven steps involved

in the calculation of Sensex.

- Step#1: First, we must list all 30 stocks which

form the constituent of Sensex. To know the list of 30 shares and their

weight in Sensex,

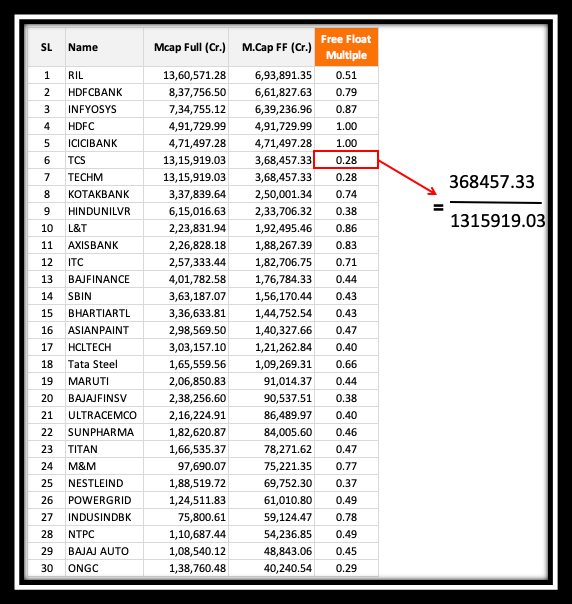

- Step#2: We must then note down the full and free-float market cap of these companies. We can get these numbers from the individual stock's pages on BSE’s website.

- Step#3: Once the full-market cap and free-float market cap of

all 30 stocks are known, we can now calculate the free float

multiple for each constituent. Do it by dividing the free-float

market cap by the full-market cap. This number will be mostly below one

(1). For some companies, its peak value will be one.

- Step#4: The free-float market multiple is rounded off as per the following table. Suppose a stock’s free float multiple comes out to be 0.28. Then as per the table, its free float factor to be used is 0.3 for Sensex calculation.

- Step#5: Now, recalculate the free-float market cap using the revised free-float factors (see above). The revised free-float market cap will be a full-market cap multiplied by the free-float factor.

- Step#6: Now, calculate the sum of the free-float market cap of all 30 stocks. This value will be our total free-float market cap.

- Step#7: It is the final step. We will have to use a formula to calculate the Sensex. It looks like this:

In

the above formula, there are three components:

1.

Total

Free-Float Market Cap: This is the value we

have calculated in Step#6 above.

2.

Base

Year Index Value: The base year for

Sensex is considered as 1978-79. In 1978-79, the Sensex is assumed to be at 100

points (the present number is about 55,000 points).

3.

Base

Year Market Cap: A number for base

year market cap must be calculated. How to do it? Frankly, I do not know.

Neither it was available on the BSE India’s website. But I assume that this

value must be around 11,473 crores.

Considering

these assumptions and the Sensex formula, today’s value of Sensex will be about

55,000 points.

Conclusion

In the year 1979, the Sensex is assumed at 100 points. It means

in the next 42-Years the Sensex rose from 100 points to 55,500 points (today).

It means it grew at an annualized rate of 16.24% per annum.

At growth rate of 16.24% per annum, Rs.1 lakhs invested in

Sensex in 1979 will become Rs.5.55 crore today (2021).

The assumed value of Rs. 11,473 Crore as the base year market

cap is unconfirmed. But I think it conveys the point about how Sensex is

calculated. I tried to get the confirmation from BSE India’s website, but I

could not get it. What was available there was a mention of Index Divisor without

disclosing any numbers. So that was not helpful.

Source BSE

Hope you like this follow

for more useful content.

Wise investing

Knowledge is growth.

9316280063

Comments

Post a Comment

If you have any doubt let me know about investing & different trading ideas